Hold It or Fold It - Getting Started with Rental Property Evaluation

/If you are new to real estate investing, there are some things to consider when buying an investment property.

First - Consider the location of the property. Is the property in a desirable part of town? Is it an area with with many tenant opportunities? Is it near public transportation? The area will also determine what the property can rent for. Be sure to look at what neighboring properties are renting for and note their condition.

Property Due Diligence -

Repairs : what repairs will you need to make in order to make the property rentable? If you are used to flipping, there are different repairs that will be necessary if you are now planning on renting. Such as being able to get away with not including some appliances when flipping, but needing to provide those to make tenants choose your property over others available. What repairs are necessary for health and safety of your tenants and to limit your liability as the owner?

Holding Costs : what will insurance, taxes, vacancy, utilities, etc cost you over time? What will you need to reserve for any repairs?

Financing : what financing are you able to get? how much will you be required to put down? and after all of that, will the property cash flow. Not only will you want your investment to cash flow, but your lender will feel more comfortable providing financing to you if your investment “pays for itself”. Hopefully in addition to the monthly cash flow, your property will appreciate over time. This will allow you to sell for a profit on top of it generating monthly cash flow to you over time.

You will hear us preach this time and time again. But money is made on the buy. Make sure you do not get excited about a seller, wholesaler or agent’s sexy numbers of what you can rent a property for. Be sure you do not overpay for the property.

Be a good landlord - if you can keep tenants in the property for long periods of time rather than needing to get new tenants constantly, it will make your life and your wallet better.

TABS provides financing to landlords in Colorado. And our management team has been a landlord - we are happy to counsel you if you are just getting started.

Good luck!

Homeowners Associations

/first - what is a home owners association? a real estate developer will generally set up a home owners association in a master planned community. this association will determine rules or covenants for the people who live there, generally to keep the look of a community consistent and to make sure that everyone keeps up the neighborhood - removing trees that are dead, not keeping a recreational vehicle parked for an extended amount of time or changing the paint color unless approved. the HOA will also collect assessments from the home owners in order to maintain common areas. The developer will generally be a member of the HOA until an agreed upon number of homes are sold. A recent development in Colorado is that an association must be managed by someone or an entity with a CAM (community association manager) license. This is generally necessary because the management of the HOA handles funds from sometimes a sizeable amount of people and those need to be properly accounted for and disbursed to protect the owners who live within the community.

another consideration in properties with home owners associations, is whether or not a traditional lender can provide financing. there are instances, such as the case, with non-warrantable condos where a portfolio or alternative financer would be required. a non-warrantable condo could exist for example if there are more owners within a community who do not occupy their property as their primary residence than people who do. this information is provided by the homeowners association. some banks find these loans riskier than a community that is a majority owner occupied. if you do find aproperty within one of these subdivisions, also consider your exit strategy. will your end buyer be able to get financing? or does this limit your pool of buyers?

real estate investing is all about whether or not a deal makes financial sense, unlike your primary residence where there is an emotional element: a desire to be in a certain neighborhood, near a certain school, a property with blue shutters, whatever the case may be. homeowners association dues can be pricey, especially in communities with extra amenities such as clubhouses, pools, fitness centers or golf courses. homeowners dues could rise. these liens also take a superior position to any loan should you not pay them which would be of great concern to your lender. when evaluating a property, it is always wise to think of multiple exit strategies. should this house not flip, what do i do? if the market changes, how do i deal with this property? think of these items: will you be able to rent out the property if needed? would i be able to re-finance my hard money loan?

we are here to help and call attention to these issues as they are discovered. not only do we have experience as being a hard money lender to colorado investors buying properties with home owners associations, but we have developed projects and set up these homeowners assocations, been directors of their boards of directors. if you ever have any questions, we are here to help!

what should you diy?

/As a Flipper, it is beyond important to keep costs low. One way of doing that is to perform some work yourself. If you happen to have a career in construction, this is a no-brainer. But for many flippers, this might be your first experience building something yourself. Working for you is the ability to access tutorials online or in person. YouTube has endless videos for just about any piece of the rehab project and Home Depot offers free classes if you found a topic of interest to you. Always consider if your work will not be up to the quality necessary for the home to fetch top dollar. Some ideas for just getting started are below, but as you educate yourself more, the options are endless to how you can save yourself money.

- demolition

- light landscaping, tree trimming, lawn maintenance, clean up

- some painting

- install hardware on cabinets

- install doors

- hang mirrors

- install towel bars

- post-construction clean up

- light staging

real estate vs. the stock market

/Investing in real-estate Vs Stock Market

When it comes to long term financial plans, investments play an integral role. Besides all the other areas of expenditure, investing in a prospective field is a great way of increasing the financial resources. Real-estate and stock market are among the mostly targeted areas in terms of investing. Potential investors wonder whether they should invest in stock market or real-estate; this article reveals the facts related to both the options, so you can decide the best matching option for you. Under general circumstances, investing in real-estate is considered to be the best option by many investors; however, it may depend on the facts like personal interest and preference too.

Real Estate

One of the most obvious benefits of investing in real-estate is that it is that it is a physical property. Since it is a tangible asset, the owner can inhabit, renovate and sell whenever it is necessary. Also, owning a home is an important aspect for a person’s life; after all, it is a tangible aspect that is associated with a measure of success.

Apart from that, there are some other benefits associated with real-estate investment:

- The chances for defrauding in this sort of an investment are fairly low. In fact, since it is a tangible aspect, you can evaluate the same thoroughly. You can see and assess the condition of the property and current value easily.

- Leveraging the real-estate investment will be relatively safer compared to the stock market investments.

- In the event of inflation, real-estate investment will provide protection. As a matter of fact, inflation maximizes the value of the property parallel to the cost of living and the power of purchasing of the respective currency.

- Even after the initial investment, you can develop the land and increase the return on the investment. This is exactly what happens during fix and flip business.

- If necessary, you can immediately convert your investment into a revenue generator with leasing or rental agreements.

Stock Market

When it comes to stocks, investing on them is a riskier compared to real-estate. Things can become worse upon inflation in contrary to a real-estate investment. Nevertheless, mentioned below are some of the notable benefits of stock-market investments.

- Investing in stock market is relatively effortless.

- If you can end up with high-quality stocks, you can expect a good annual income

- You have the opportunity to reinvest the dividends.

Despite the mentioned benefits, stocks are associated with several drawbacks. These drawbacks has made stock market investing is a less attractive one compared to the real-estate market. The tumultuousness of the stock market during the complex economic situation will cause significant losses for the investor. Unpredictability and the necessity for sound knowledge in investing are other significant drawbacks pertaining to stock-market investing.

how to manage your new business' finances

/Regardless the size, managing money correctly is exceptionally important for any business. The key to survive in a volatile economy and heavy competition is the proper financial management. When it comes to small businesses, however, it needs a great amount of caution in order to put the things right from the beginning. To run a business, you obviously need more than a good idea; proper financial structure is an essential aspect to generate good profit and stay credible. Here are some good tips to manage small business finance.

Educate Yourself

First thing you should consider when it comes to small business finance is getting sufficient knowledge about the essential aspect of finance. Particularly, at the initial stage, you should know how to read the financial statements at the least. Reading financial statements correctly will allow you to gain a strong insight about the sources of money and the changes occurred.

Cash flow statement, statement of the shareholder’s equity, balance sheet and the income statement are the essential details included in the financial statements. Each of these aspects represents different segment of information you should know and referring them with good awareness is essential for a good financial management.

Maintain Personal Finances Seperately

Personal finance should be strictly kept away from your business. One of the most effective ways to do so is getting a credit card or debit card for the business and put all the business related expenses on it. It is a great way of keeping tracks on the expenses incurred. However, you should be smart enough to make the payments on time; otherwise, penalty fees will incur more cost on your business budget. Also, having a separate bank account for your business is mandatory.

Reduce Costs

When it comes to a small scale business, it is quite important to know how to reduce costs. . Know about both fixed and variable costs. In general, fixed costs are mandatory costs that occur – no matter whether your company generates revenue or not. Purchasing of infrastructure, furniture, machinery, building rental, salaries etc. are fixed costs that can be hardly changeable even when you run at a lost.

Always Track Performance

Make sure that you maintain a strict watch on money; they way the money moves particularly when the large payments are involved. Don’t neglect the small, frequent costs as they accumulate into big sums over the time. Compare the financial statements with the past month and year to get a clear insight about the financial control. Such approach will help you to identify the potential areas you can rectify.

If you are not 100% sure about your knowledge about business finance, the best approach is to hire a professional. Although it might cost you some money to employ a professional business finance expert, at the end of the day, it will be a long-term investment considering the benefits associated with.

getting started

/

New Year? Is It Time for You to Get Started in Real Estate Investing?

Starting your own business is a fulfillment of a long-cherished dream. Making your own decisions, being your own boss and earning more money are the prime expectations of any entrepreneur. Apart from that, anyone can experience the sense of accomplishment and the pride which is hardly found when you work for someone else. Besides, in order to fulfill this dream, you need a systematical approach.

- Build self confidence

The secret behind the strong foundation of success is nothing but the self confidence. Therefore, if you expect to achieve success for your business, you surely need to develop self confidence. For an entrepreneur, self-confidence is an exceptionally powerful tool. Businesses are always associated with calculated risks; willingness to take these risks increases with the self-confidence. Call it ‘going extra-mile’, ‘break new ground’ or ‘achieve success’, you cannot achieve none of them if you lack of confidence.

- Make a business plan

In fact, making a plan for your business is the very first step you must make after deciding to start a business. This should include all the information including the type of the business, the operational structure, partners (if any), deadlines etc. The amount of money you expect to invest and the way you wish to raise the capital is an exceptionally important aspect. Make sure that the goals you set are practically achievable. Setting up unrealistic goals can discourage you very soon.

- Be ready with knowledge and skills

It is always good to possess expertise knowledge in the field of business you are going to start. However, if you don’t have such expertise knowledge, you can consider hiring an expert/coach (either on permanent basis or freelance basis). Deal-making, marketing, SEO, web development etc. are the most common areas you would need the assistance of a professional.

- Start promoting

No matter how good your products or services, you cannot expect to succeed if you don’t promote it. What you spend on advertising and promoting is a compulsory investment for your business. Don't be shy about letting people know you would like to get started in Real Estate Investing. The more people who know about your business, the more people have potential to bring you an investment, valuable service or partnership.

Most business ideas remain unexecuted due to financial burdens; however, the use of hard money allows new investors to get started with less cash requirements than traditional financial institutions. Browse our previous blogs for how to evaluate properties.

An Introduction...

/TABS, LLC is a locally owned and operating hard money lending company currently serving the State of Colorado. We are able to offer non-owner occupied real estate loans. We currently offer bridge, buy and hold, fix and flip, vacant land and new construction funding. Please give us a call or shoot us an email to discuss any upcoming Colorado projects!

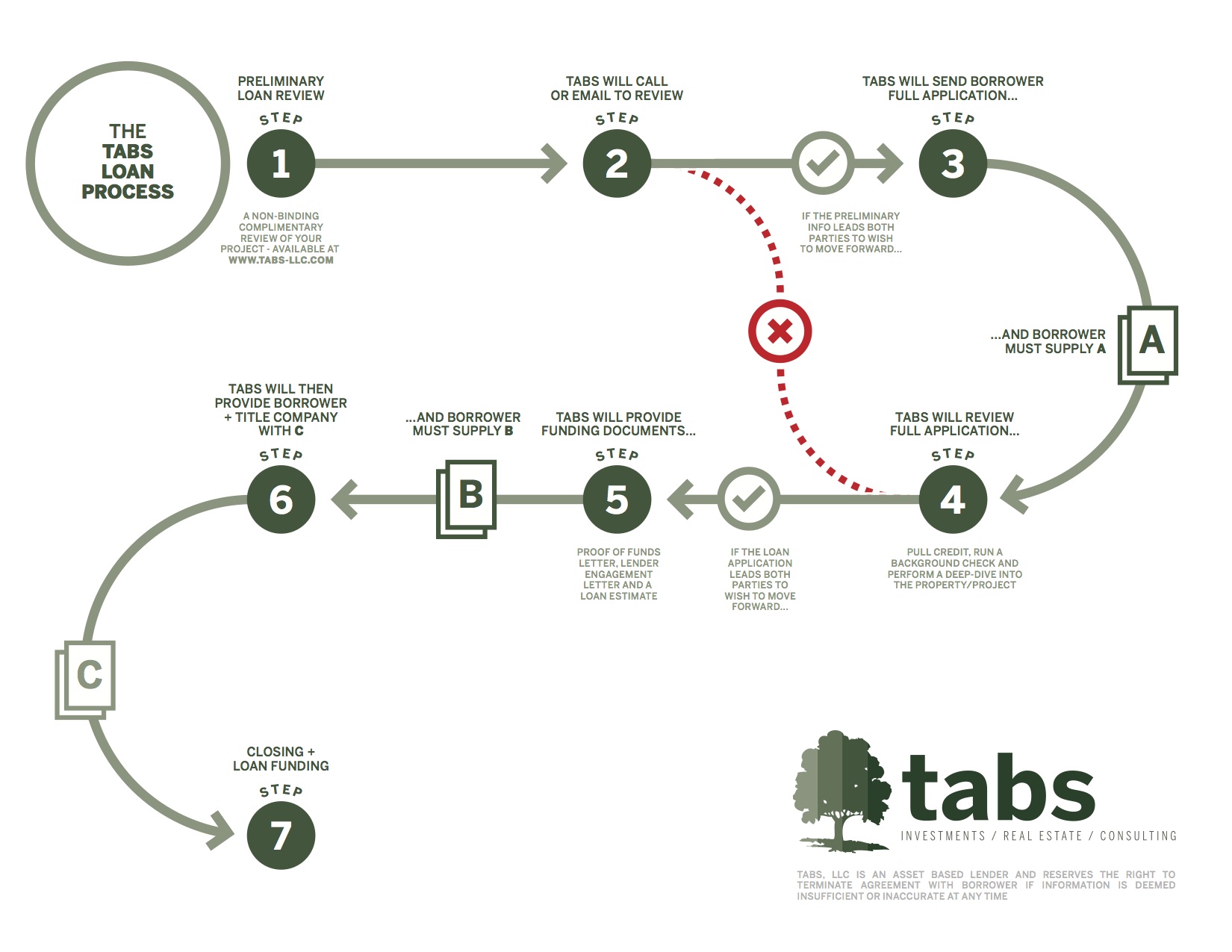

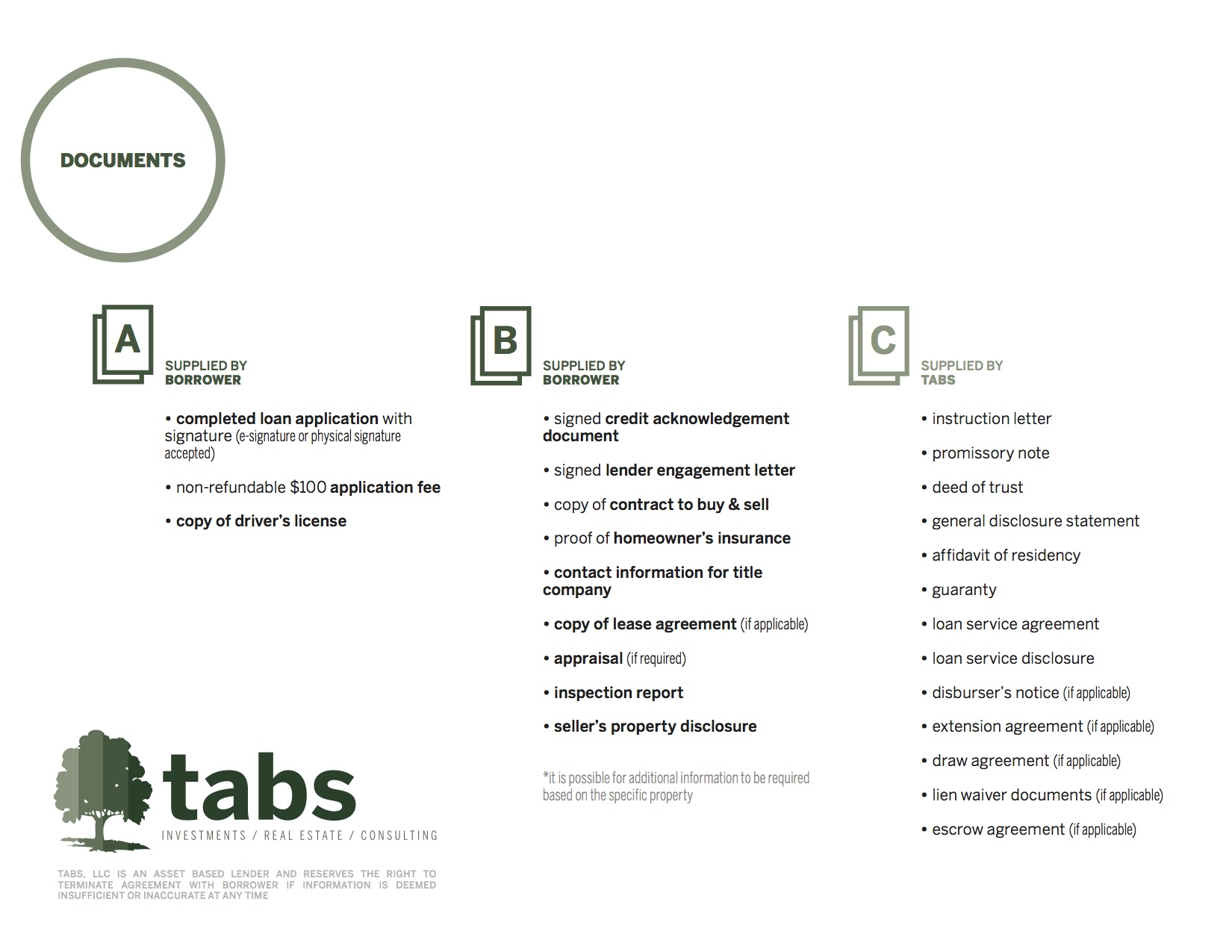

Our Loan Process

/so you have a deal, now what?! we hope that this info graphic gives you an idea of our loan process, so that you can be prepared when the right deal comes up. remember, that we are accept-based lenders, so the property is the most crucial part of underwriting. and call us with ANY questions! we know it's tricky and we are here to help.

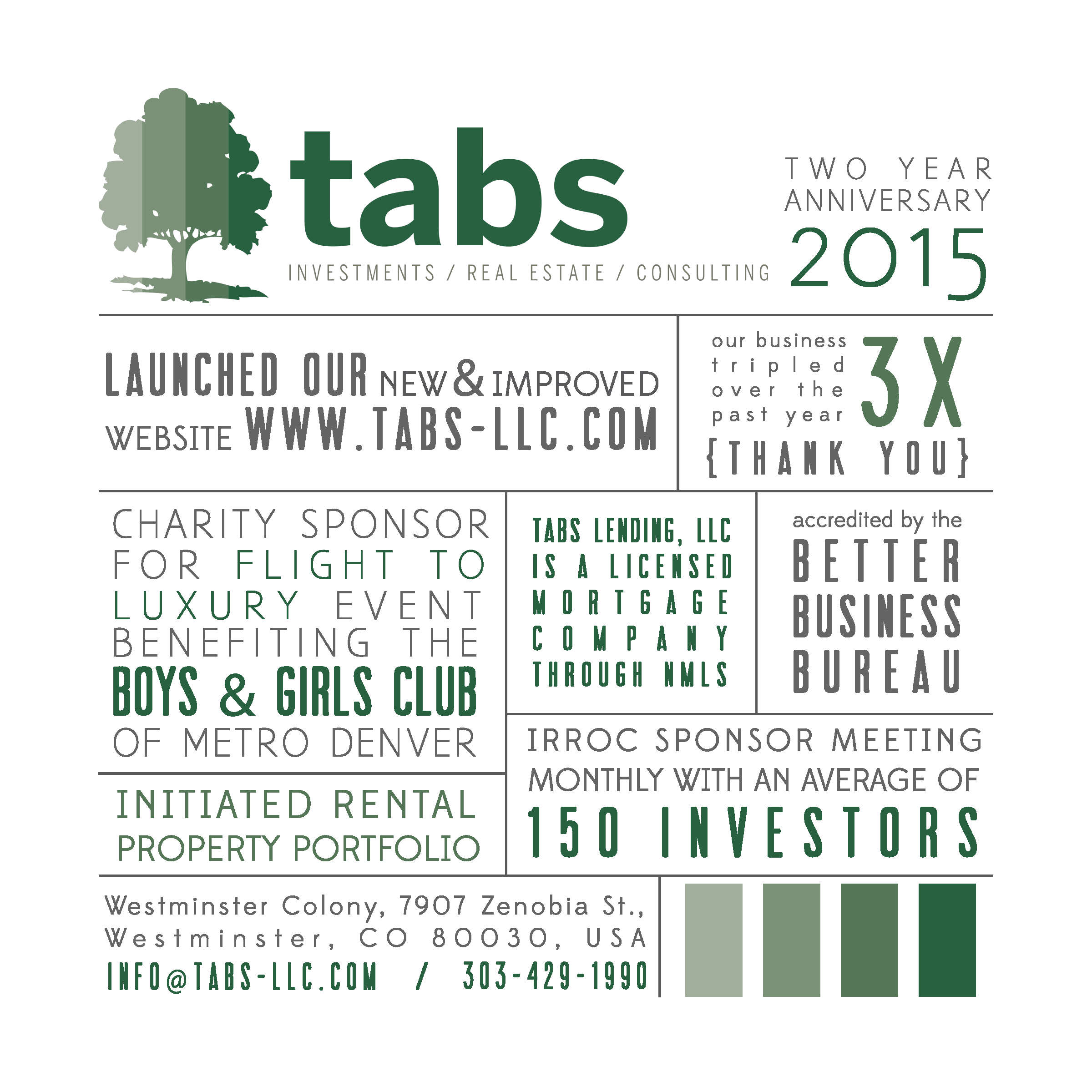

Happy Anniversary To Us!

/“THANK YOU / THANK YOU / THANK YOU”

Today is a day for THANK YOU's! While we have been investing, developing and lending in real estate for much longer, our branded company is now 2 Years Old! We thank you for allowing us to be a part of your projects in the past, present and hopefully in the future! It has been a real joy to work with all of you and now celebrate this anniversary. THANK YOU, THANK YOU, THANK YOU!